Two major developments this week in self-publishing. Lulu.com is going public and looking for a $50 million public offering – interestingly on the Canadian market.

Two major developments this week in self-publishing. Lulu.com is going public and looking for a $50 million public offering – interestingly on the Canadian market.

Why Canada? The local equity market has been on bit of a boom, and in 2009, saw 28 new issues worth C$1.8 billion, compared with the C$682 million raised from 57 new issues in 2008, the story says. Less stringent scrutiny on the Canadian exchange is also probably the reason why that seems more feasible than U.S. markets.

Remains to be seen if CSX would be receptive to a still-nascent market player like this. Also, as Newsobserver points out, “U.S. investors could still buy shares. And once it’s established as a publicly traded company in Canada, Lulu could generate investor interest and shift to a U.S. stock market.”

What’s this mean for current Lulu authors? Not much, but a high-valued IPO will demonstrate that Lulu’s a major player and that self-publishing is gaining as a share of the market. Lulu’s higher profile could potentially increase the legitimacy of publishing with Lulu, and self-publishing in general. Though some may argue the profitability of publishing with Lulu, given the price per book, no one can argue the profitability of running a high-profile subsidy publisher.

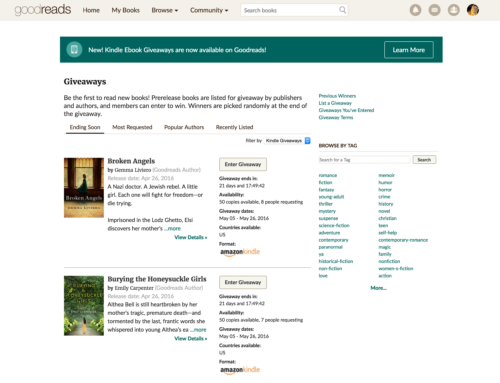

The Kindle is also expanding, offering Kindle books to the international market. One of the major knocks against the Kindle is that it has been U.S.-only. Not anymore:

The scheme, which was only available in the US previously, will support English, German and French languages, but neither Mandarin or Spanish, two more popular languages. Amazon has confirmed that it will be adding more languages to the Kindle in the forthcoming months.

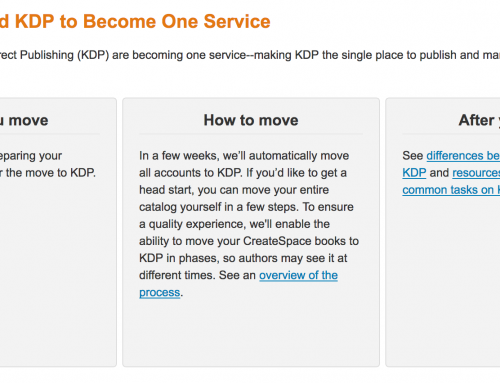

Published works can then be sold through Kindle store to customers across the world who can download them to their Kindle devices over the air for a fee of which Amazon will keep 65 percent (ed: that is shocking).

Interestingly, Lulu recently expanded beyond self-publishing into offering ebooks by traditionally-published authors, as a way of attempting to gain a share of the Kindle’s business – or at least offering authors an additional place to market.

Lulu is counting on the traditional titles to draw readers who stumble across unknown authors, Abbott said. For example, someone searching for books on golf might find a book about golf courses in Raleigh.

“As that happens, we’ll give Lulu authors a better chance to sell more books because there will be more eyeballs,” he said.

Ideally, this will help all Lulu authors.

Update: Countering the criticism about the terrible royalty rate for the Kindle, Amazon announced a new 70% option.

Amazon.com (NASDAQ:AMZN) today announced details of a new program that will enable authors and publishers who use the Kindle Digital Text Platform (DTP) to earn a larger share of revenue from each Kindle book they sell. For each Kindle book sold, authors and publishers who choose the new 70 percent royalty option will receive 70 percent of list price, net of delivery costs. This new option will be in addition to and will not replace the existing DTP standard royalty option. This new 70 percent royalty option will become available on June 30, 2010.

Cheryl Gardner at Pod People made some additional important points, especially regarding digital rights management.

Baby steps, but this is all good. One of the most important things here is that the DRM decision has now been handed over to the rights owner, where it belongs. As far as the pricing structure, well, some Indie authors will have a problem with this and so will some readers who want cheap content. It used to be a good Indie marketing strategy to have the cheapest content out there in order to entice more readers to take a chance, but to me $1.99 is still a steal, and 3-10 megs is still a lot for a straight text ebook.

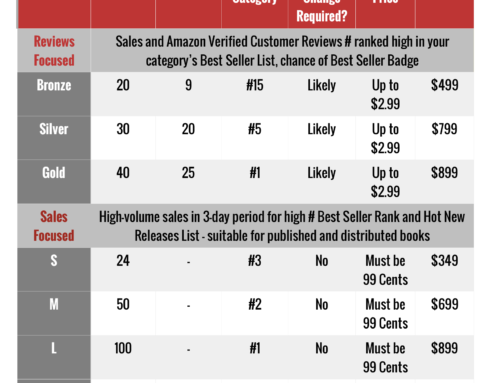

In the past, Amazon allowed indie authors to set the price to free for indie books, but now only allows that for large traditional publishers – making it even more difficult for indie authors to get a footing. Amazon has made it harder yet again by raising the price to $2.99, but this is still a competitive price.

Get an Editorial Review | Get Amazon Sales & Reviews | Get Edited | Publish Your Book | Enter the SPR Book Awards | Other Marketing Services

Please, anyone. Has Lulu folded? I haven’t been able to bring up their website for 3 days now. Today is March 13th,2011.

That’s strange. Opens up fine for me. I was on there yesterday too.

It really is strange. Maybe Lulu has blocked me from going to their website for demanding they get more competent employees for their IT department.

I used Lulu twice. Once on a do-it- yourself project and one where I paid for professional services. I had no problems at all for my do-it- yourself project but a completely different story for the professional services. I spend over $500 for professional services. I did not receive my full services and have spent months submitting and resubmitting help desk tickets to get this matter resolved. Nothing! Stay away from the professional services unless you have money to waste or time to lose! The worst customer service ever!!!!